The fintech industry continues to boom as we move into 2025. With consumers demanding faster, more secure, and personalized financial services, the need for innovative fintech applications is higher than ever. Startups, banks, and tech companies are racing to offer better digital experiences, driving competition and growth in the sector.

For businesses planning to enter this exciting space, understanding the fintech app development cost is crucial. Accurate cost insights help in budgeting, choosing the right development path, and setting realistic project goals. Whether you’re a startup founder, a CTO, or an investor, knowing the cost to build a fintech app can significantly influence your success.

1. Fintech market overview in 2025

The global fintech market is expected to reach new heights by 2025. According to industry projections, the market size could exceed $300 billion, fueled by widespread mobile adoption and the growing demand for digital financial services. As more people use smartphones for banking, investing, and payments, businesses see an urgent need to develop powerful fintech solutions.

Key drivers behind this rapid adoption include better internet connectivity, increased trust in digital platforms, and the rising popularity of cashless transactions. Additionally, regulatory support for open banking is encouraging new players to enter the market with innovative offerings.

Emerging trends are also reshaping fintech app development. Artificial intelligence (AI) is helping apps deliver smarter financial advice and fraud detection. Blockchain technology is making transactions more transparent and secure. Personalized finance, powered by big data, allows apps to offer tailored services based on user behavior.

As a result, businesses must keep an eye on these changes when estimating fintech app development pricing and planning their strategies. Choosing the right technology stack, integrating services like AWS (Amazon Web Services), Microsoft Azure, or Google Cloud Platform, and ensuring seamless payments via platforms like Stripe and Plaid are now essential parts of the process.

In such a competitive landscape, having a clear understanding of fintech app cost estimation is not just helpful—it’s a necessity. By learning how to optimize fintech app development costs early, companies can better allocate their budgets and focus on delivering standout products.

Read more >>> How Much Does It Cost to Develop A Healthcare App?

2. Types of fintech applications and their cost estimates in 2025

When planning a fintech project, it’s important to understand the different types of apps and how they affect the fintech app development cost. Each type comes with its own features, complexity, and pricing. Let’s explore the most popular categories.

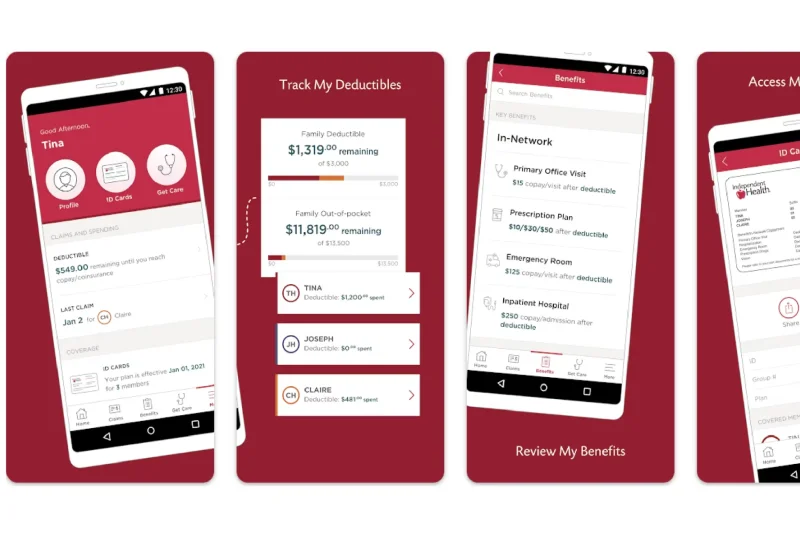

2.1. Digital banking apps

Digital banking apps allow users to manage accounts, transfer money, make payments, and set up budgeting tools. Security features like two-factor authentication are a must.

- Popular features: Account management, fund transfers, bill payments, savings goals.

- Development time: 6–12 months.

- Estimated cost: $50,000 – $250,000+.

These apps often integrate with AWS (Amazon Web Services) or Google Cloud Platform to ensure scalability and security.

Read more >>> How Much Does It Cost to Make a Dating App in 2025?

2.2. Lending platforms

Lending platforms help users apply for loans, get credit scores, and manage repayments easily.

- Popular features: Loan application forms, risk assessment, payment schedules, reminders.

- Development time: 7–14 months.

- Estimated cost: $60,000 – $300,000+.

Compliance with financial regulations impacts the fintech app development pricing here.

2.3. Investment apps

Investment apps allow users to manage brokerage accounts, invest in stocks, and get robo-advisory services.

- Popular features: Trading tools, portfolio tracking, algorithmic advice.

- Development time: 8–15 months.

- Estimated cost: $70,000 – $350,000+.

Many of these apps integrate APIs like Plaid to fetch real-time financial data.

2.4. Insurance apps

Insurance apps make it easier for users to manage policies, submit claims, and get quotes instantly.

- Popular features: Policy management, claims filing, AI-based risk analysis.

- Development time: 7–12 months.

- Estimated cost: $60,000 – $300,000+.

Security and compliance requirements can significantly affect the fintech app development cost for insurance platforms.

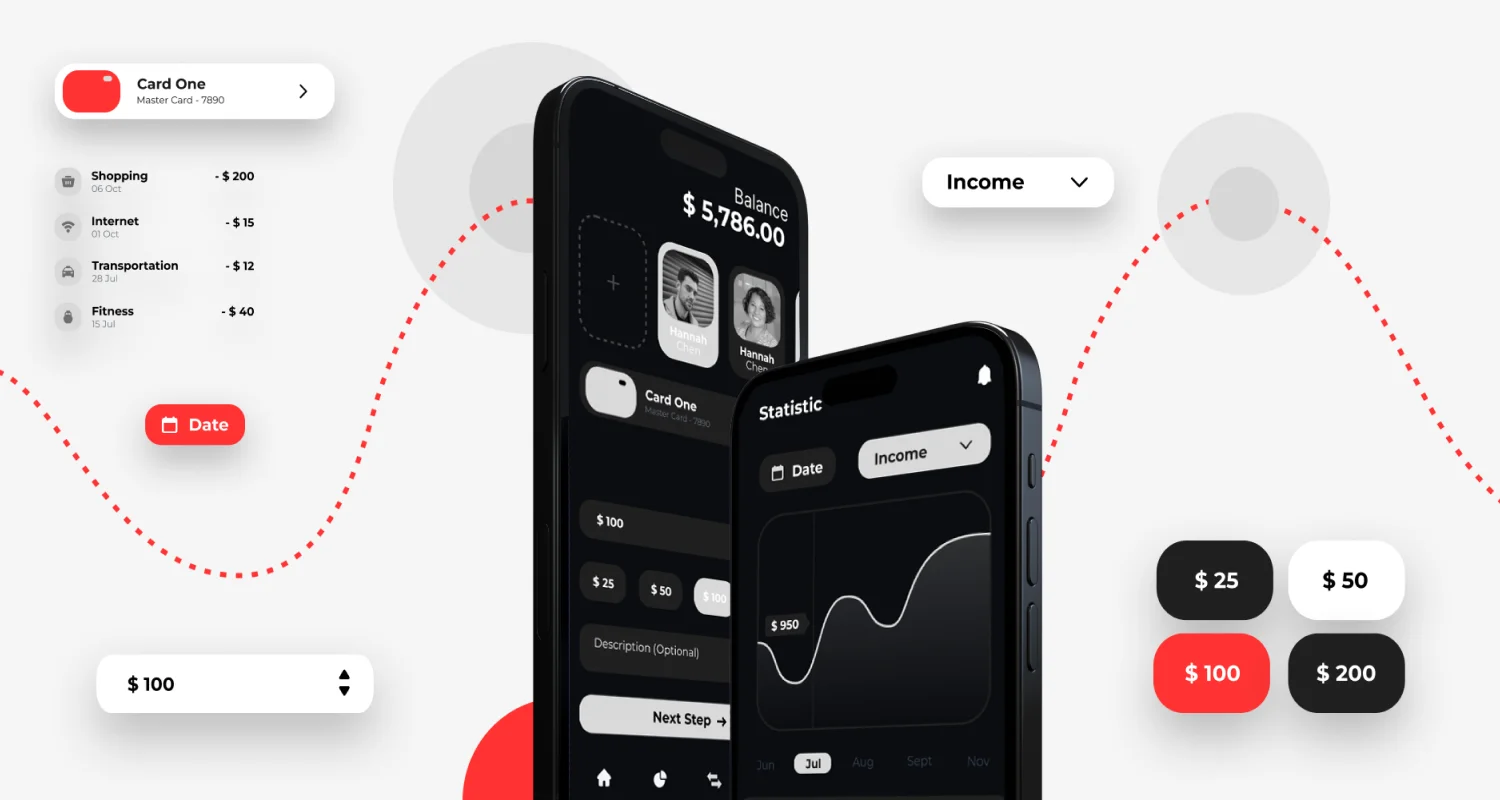

2.5. Personal finance apps

These apps help users with budgeting, tracking expenses, and setting financial goals.

- Popular features: Expense categorization, savings targets, investment trackers.

- Development time: 5–10 months.

- Estimated cost: $40,000 – $200,000+.

Using cloud services like Microsoft Azure can help optimize performance and optimize fintech app development costs.

Read more >>> How Much Does It Cost to Make an Educational App?

2.6. Payment and money transfer apps

Payment apps focus on easy transactions, peer-to-peer transfers, and cross-border payments.

- Popular features: Digital wallets, international transfers, QR code payments.

- Development time: 6–12 months.

- Estimated cost: $50,000 – $250,000+.

Integration with trusted payment services like Stripe is essential.

Read more >>> How Much Does App Development Cost In 2025?

2.7. Cryptocurrency apps

Cryptocurrency apps let users buy, sell, and manage digital assets.

- Popular features: Crypto wallets, exchanges, live price tracking, secure authentication.

- Development time: 8–16 months.

- Estimated cost: $70,000 – $400,000+.

High-level security standards and compliance with regulations raise the fintech app cost estimation here.

2.8. Robo-advising and stock trading apps

These apps offer automated financial advice and stock trading features.

- Popular features: Automated portfolio rebalancing, real-time market analysis, custom investment strategies.

- Development time: 9–18 months.

- Estimated cost: $80,000 – $450,000+.

This type of app often uses a sophisticated technology stack to handle large volumes of user data.

2.9. Consumer finance apps

Consumer finance apps focus on services like Buy Now Pay Later (BNPL), credit building, and debt management.

- Popular features: Installment payment options, credit tracking, debt payoff planners.

- Development time: 6–12 months.

- Estimated cost: $50,000 – $250,000+.

The growing BNPL trend is heavily influencing fintech app development strategies in 2025.

3. Factors influencing fintech app development costs

Several important factors can affect the fintech app development cost. Understanding these elements can help businesses plan better and avoid unexpected expenses during the project.

3.1. App complexity and features

The complexity of an app is one of the biggest drivers of cost. Basic apps with simple features like account management or transaction history are more affordable. But if you add advanced features such as AI-based financial advice, real-time analytics, or fraud detection, the fintech app cost estimation rises significantly.

The more screens, workflows, and integrations an app needs, the more development time and resources it will require. Planning the feature set carefully is key to managing the overall budget.

3.2. Technology stack and platform choice

Choosing the right technology stack also impacts the fintech app development pricing. Native development (building separate apps for iOS and Android) usually costs more because it requires two separate codebases. Cross-platform frameworks like Flutter or React Native can help reduce costs by allowing code sharing between platforms.

Moreover, selecting cloud services like AWS (Amazon Web Services), Microsoft Azure, or Google Cloud Platform can influence hosting and infrastructure costs. The right choice depends on the app’s scalability and security needs.

3.3. Compliance and security requirements

Security is non-negotiable for fintech apps. Meeting strict regulations such as GDPR, PCI DSS, and other regional compliance standards can add significantly to the cost to build a fintech app. Apps must also include strong encryption, multi-factor authentication, and regular security audits.

Higher compliance needs mean more work in terms of backend development and ongoing maintenance, increasing the fintech app development cost.

3.4. Development team location and expertise

Where your development team is based can make a big difference. Hiring developers in North America or Western Europe is generally more expensive than hiring teams from Eastern Europe, Asia, or Latin America.

The team’s expertise also matters. Experienced fintech developers who understand complex financial systems and regulations may charge more, but they can help avoid costly mistakes later. Balancing cost and quality is important when choosing a team to optimize fintech app development costs.

3.5. Integration with third-party services

Many fintech apps rely on external APIs and services to provide essential features. Integrating services like Stripe for payment processing or Plaid for financial data aggregation saves development time but adds licensing and subscription fees.

The more third-party integrations you use, the higher the development and maintenance costs. It’s important to plan integrations smartly to avoid inflating the fintech app development cost unnecessarily.

4. How to optimize fintech app development costs

Building a fintech app doesn’t have to break the bank. Here are some smart ways to manage and lower the fintech app development cost without sacrificing quality.

4.1. Adopting a Minimum Viable Product (MVP) approach

Starting with a Minimum Viable Product (MVP) is a proven way to optimize fintech app development costs. An MVP focuses only on core features that deliver real value to users. This allows you to launch faster, gather feedback, and make improvements without overspending.

4.2. Considering outsourcing development to cost-effective regions

Hiring skilled developers in cost-effective regions like Eastern Europe, Southeast Asia, or Latin America can significantly reduce the fintech app development pricing. Outsourcing also gives access to a broader talent pool without compromising on quality.

4.3. Utilizing cross-platform development frameworks

Choosing a cross-platform framework like Flutter or React Native can cut development time and cost. Instead of building two separate apps for iOS and Android, you can reuse most of the code, lowering the overall cost to build a fintech app.

4.4. Leveraging existing fintech APIs and services

Instead of building everything from scratch, integrate trusted services like Stripe for payments or Plaid for financial data. Using existing fintech APIs speeds up development, enhances reliability, and helps manage the fintech app cost estimation more effectively.

4.5. Prioritizing essential features and planning for scalability

Focus first on must-have features that solve users’ main problems. Save advanced functionalities for future updates. Also, design your app architecture to scale easily as your user base grows, ensuring you don’t face major expenses later.

At Stepmedia, we specialize in helping businesses plan and manage their fintech projects efficiently. If you want expert guidance on fintech app development cost and strategies to get the best results, visit Stepmedia. Let’s bring your fintech idea to life, smarter and faster!

5. Conclusion

Understanding the many factors that impact the cost to build a fintech app in 2025 is key to successful project planning. App complexity, technology stack, compliance requirements, team location, and integration choices all play major roles in the final price.

Looking ahead, the demand for fintech solutions will only grow. While new technologies like AI and blockchain may add to the fintech app development cost, they also create new opportunities for innovation and market leadership. By making informed decisions today, businesses can thrive in the dynamic fintech landscape of tomorrow.